Working a standard 9-5 job often leaves pet owners grappling with the question of what to do with their beloved furry companions during the day. While many dogs are perfectly content lounging at home, others may benefit from the stimulation and socialization offered...

Navigating Car Accident Injuries in Mississauga – Should You Engage a Car Accident Lawyer?

Mississauga, Ontario, stands as a bustling metropolis known for its vibrant culture, diverse communities, and economic vitality. However, amidst its hustle and bustle, the city grapples with a concerning reality – a high incidence of car accidents occurring daily. For...

HST Renovation Rebate

In the realm of home improvements, renovations can be both exciting and daunting. They breathe new life into your living space, enhance functionality, and potentially increase property value. However, the costs associated with renovations can often be substantial....

Finding the Perfect Painless Family Dentist in Downtown Toronto Open on Evenings and Saturdays

In a city as populous as Toronto, the abundance of dental practices can make it challenging to find the ideal painless family dentist, especially one located downtown and open during evenings and Saturdays. However, with the right strategies and resources, you can...

The Importance of Air Duct Cleaning for Your Brand New Home

Congratulations on your new home! It’s an exciting milestone, filled with dreams and possibilities. Amidst the joy of settling in, you may have heard friends recommending air duct cleaning for your brand new house. You might be wondering, "Is it really necessary? Why...

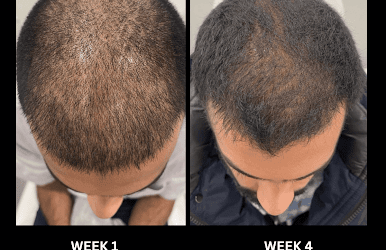

Understanding PRP Treatment for Hair Loss

Hair loss can be a distressing experience, impacting self-esteem and confidence. For those seeking effective solutions, Platelet-Rich Plasma (PRP) therapy has emerged as a promising option. In this article, we delve into what PRP treatment entails, how it works, its...

Exploring Private Mortgages – A Solution for Buying a House in Etobicoke, Downtown Toronto with Poor Credit Score

Are you dreaming of owning a house in the vibrant neighborhoods of Etobicoke, nestled within the heart of Downtown Toronto? The allure of living in such a prime location is undeniable, but what if your credit score doesn't quite match up to the traditional standards...

Navigating Kitchen Renovations Near Me in Hamilton, Ontario: A Guide to Choosing the Right Kitchen Design Company

When it comes to kitchen renovations near me in Hamilton, Ontario, the abundance of kitchen design companies can make the selection process overwhelming. Transforming your kitchen is a significant investment, both in terms of time and money, so choosing the right...

Navigating Eating Disorder Therapy in Brantford, Ontario: A Comprehensive Guide

Eating disorders can have a profound impact on one's physical and mental well-being, making it crucial to seek professional help for effective treatment. If you or someone you know is in Brantford, Ontario, and struggling with an eating disorder, this article will...

My furnace needs repairs! What now?

When your home furnace needs repairs, it's important to address the issue promptly to ensure the comfort and safety of your home. Here's a step-by-step guide on what to do when your furnace requires repairs: Safety First: If you suspect a gas leak or any other safety...

What are wire rope sheaves used for?

Wire rope sheaves, also known as pulleys or blocks, serve various purposes in mechanical systems that involve the use of wire ropes or cables. These components are essential for transmitting force and changing the direction of a wire rope. Here are some common...

Are you considering family mediation? This is why it could help!

Family mediation is a process in which an impartial third party, known as a mediator, helps families resolve conflicts and reach agreements on various issues. This can be particularly beneficial in situations involving divorce, separation, child custody, and other...

The environmental benefits of ebikes and electric vehicles.

Electric bikes, or e-bikes, offer several environmental benefits compared to traditional bicycles and other forms of transportation. Here are some of the key environmental advantages of e-bikes: Reduced Greenhouse Gas Emissions: E-bikes produce lower emissions...

Exploring Storage Solutions in Strathroy: Finding the Best Storage Units Near Me

Living in Strathroy comes with its unique charm, but when it comes to managing space at home or your business, finding convenient storage solutions becomes a priority. Whether you're downsizing, renovating, or simply need extra space to declutter, the question on your...

Adding a Home Addition versus Buying a New House in Hamilton, Ontario: Weighing the Pros and Cons

Hamilton, Ontario, is a thriving city known for its rich history, scenic beauty, and diverse real estate market. Whether you are a current homeowner looking to expand your living space or a prospective buyer searching for the perfect abode, you may find yourself torn...